Business

From $26 Billion to Bust: Sam Bankman-Fried’s Astonishing Rise and Fall

Ever since his arrest, Sam Bankman-Fried has bucked advice from lawyers to keep quiet. But through press interviews, blog posts, leaks and social media, he has challenged the allegation that he is solely responsible for the world’s biggest crypto meltdown.

Now, as the trial against Bankman-Fried starts on charges that he swindled billions of dollars from his crypto platform FTX, the 31-year-old will have one last chance to tell his side of the story.

The case against the former chief executive will begin with jury selection in federal court in lower Manhattan on Tuesday, less than a year after Bankman-Fried’s empire imploded and filed for bankruptcy.

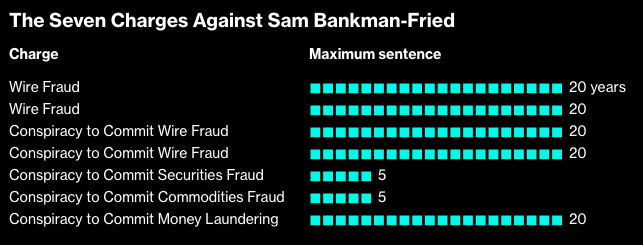

The case, which the government labeled one of the biggest financial crimes in the country’s history, will explore how an awkward 20-something from California came to run and allegedly ruin one of the largest crypto exchanges in the world. The MIT graduate faces a maximum prison term of 20 years for each of the five most serious charges.

During his trial, Bankman-Fried, who has been inside a Brooklyn jail for nearly two months for allegedly trying to influence two government witnesses, will attempt to explain away the $8 billion in liabilities Alameda Research — FTX’s hedge fund affiliate — had on its balance sheet when both filed for bankruptcy last November.

White-collar defendants rarely testify at their own trials, instead spending hundreds of thousands, sometimes millions of dollars, on top defense attorneys to do the talking. But Bankman-Fried has shown he isn’t like most white-collar defendants.

“One of the narratives he will want to present is he was the Warren Buffett of crypto,” said former federal prosecutor Joshua Naftalis, who previously worked in the unit prosecuting Bankman-Fried. “He was the name in the game and while mistakes were made, they weren’t intentional.”

A spokesman for Bankman-Fried declined to comment. He has pleaded not guilty to all seven charges, including fraud and conspiracy to commit money laundering.

Bankman-Fried founded FTX in 2019 in Hong Kong, relocating to a more friendly regulatory environment, The Bahamas, two years later. At his peak, Bankman-Fried was worth $26 billion and ran FTX from a palatial penthouse overlooking the ocean with his friends. He was a frequent visitor to Washington, donated millions to charity and rubbed shoulders with celebrities. He was widely viewed as a beacon of responsibility in an industry that many treated with skepticism.

Cracks in the crypto industry began to show in 2022, starting with the May implosion of the multibillion-dollar Terra stablecoin ecosystem. That, in turn, triggered contagion that engulfed firms from Three Arrows Capital to Celsius Network. The crisis in confidence saw crypto prices plunge. FTX, however,appeared to weather the downturn better than most, with Bankman-Fried celebrated as the “J.P. Morgan of crypto” who could help rescue ailing firms.

That would change by November, when concerns around FTX’s solvency and its ties to Alameda sparked a run on the exchange. Still, on Sunday, Nov. 6, Bankman-Fried’s net worth was a healthy $15.6 billion, according to the Bloomberg Billionaires Index. By the end of the week, it would be gone. On Friday, Nov. 11, FTX, FTX.US and Alameda all filed for bankruptcy.

Federal prosecutors will argue that Bankman-Fried used FTX as a vehicle to steal billions in customer funds and spend lavishly on speculative trading at Alameda Research, real estate in The Bahamas and gave money away in line with the effective altruism movement that supposedly underpinned the business.

The Government’s Case

After FTX and Alameda, the trading firm he started in 2017, filed for bankruptcy, Bankman-Fried went on a press tour in an early attempt to explain everything away. US prosecutors investigating the cause of FTX’s demise watched from afar, eventually asking authorities in The Bahamas to arrest Bankman-Fried on December 12.

Prosecutors plan to argue that Bankman-Fried allegedly lied to investors about the nature of the relationship between Alameda and FTX. In contrast to Bankman-Fried’s public declarations that the two entities were separate, Alameda had special privileges on FTX that gave it an unlimited line of credit. It used customer funds to make illiquid investments, prosecutors will argue. When the crypto market spiraled last year and Alameda couldn’t repay its loans, it called in more customer funds to meet the shortfall.

Bankman-Fried allegedly directed his top lieutenants to falsify information to auditors and financial statements to disguise the relationship, allowing him to continue fund raising despite the liquidity crunch.

Key to the government’s case are three cooperating witnesses; former FTX engineering director Nishad Singh, former FTX chief technology officer Gary Wang and former Alameda Research CEO Caroline Ellison.

The former executives were part of Bankman-Fried’s inner circle. They all have pleaded guilty to fraud and agreed to testify against Bankman-Fried in the hope of receiving lighter sentences.

Former FTX Digital Markets co-CEO Ryan Salame also pleaded guilty to criminal offenses but did not sign a cooperation agreement.

Based on court filings and submissions in the lead up to trial, the government has detailed what these witnesses may testify to. Singh and Wang will likely tell the jury about FTX’s code and how it was altered at Bankman-Fried’s behest. Ellison may tell the jury this allowed Alameda to borrow funds without posting collateral or be subject to margin calls.

Singh was also used as a straw donor, making millions in campaign donations in the lead-up to the 2022 election. While prosecutors dropped a campaign finance violation charge against Bankman-Fried before trial, the government will still weave his donation activity through its case, alleging this is how he spent the proceeds of his fraud.

Ellison’s testimony could be much broader and damaging for Bankman-Fried.

Prosecutors have her personal diary, notes she made of meetings with executives, lists, including one titled “Things Sam is Freaking Out About,” and allegations about how and when she knew Alameda was secretly using customer funds.

Ellison once dated Bankman-Fried, adding another layer of complexity to her role as a cooperating witness. Prosecutors allege Bankman-Fried “retained authority” over Ellison’s trading decisions at Alameda.

The “retained authority” extended to Bankman-Fried telling Ellison, who joined Alameda as a trader in 2018, to engage in secret trading to inflate the value of FTT, FTX’s cryptocurrency, to better Alameda’s borrowing power.

The government indicated it has 50 potential witnesses including former employees, investor victims, FBI agents and forensic accountants to explain the flow of money between FTX and Alameda. The jury will also hear from FTX customers, including a man in Ukraine who lost a significant portion of his life savings, to explain what their expectations were around how their funds would be used. Prosecutors, who have produced 1,300 exhibits ahead of trial, will want to portray the case as a simple fraud and steer clear of crypto minutiae, Naftalis said.

The Defense

Despite warnings from his lawyers to keep his head down, Bankman-Fried has been unusually vocal in the face of the criminal investigation. His bail was revoked in August after he showed Ellison’s personal writings to a New York Times reporter, which a judge decided was a possible attempt to scare her. Even before that he’d had a constant dialogue with journalists, recording about 1,000 phone calls with reporters while on bail, prosecutors previously revealed.

But his testimony may be one of the few options his lawyers have left. Bankman-Fried’s case suffered a setback weeks before trial when Judge Lewis A. Kaplan ruled he couldn’t call seven expert witnesses to testify.

While defense teams closely guard trial strategies, Bankman-Fried may argue that FTX’s lawyers were involved in key business decisions and he acted in good faith.

Judge Kaplan ruled last week, however, that Bankman-Fried’s lawyers couldn’t mention in their opening statement that FTX lawyers were present when key business decisions were made. It could confuse the jury and prejudice the government, Kaplan said. If Bankman-Fried wants to make that argument or present evidence on the issue later in the trial, his lawyers need to notify the judge first.

Bankman-Fried may try to rely on technical issues, rather than technicalities. He could try to put himself at arm’s length from Alameda and FTX’s engineers, arguing he didn’t have the expertise to understand the platform’s coding and wasn’t involved with Alameda’s operations.

That ties in with Bankman-Fried’s earlier public statements, and material leaked to the press, attempting to shape Ellison as someone who wasn’t up to the job of running a hedge fund with billions of dollars of assets under management. But a blame-your-ex-girlfriend strategy is “risky,” Naftalis said.

“You’re taking a set of facts and turning it into a soap opera,” he said. “You don’t want to be perceived as lashing out and making it all about them when the trial is about you. The jury might not like making this about gender or an ex treating an ex poorly.”

The trial before Judge Kaplan is expected to last up to six weeks with jury selection scheduled for Tuesday.

The case is US v. Bankman-Fried, 22-cr-673, US District Court, Southern District of New York (Manhattan).

© Bloomberg

Business

Legal Intelligence Firm redefines regulatory compliance with high-profile hire

In a world in constant flux, unpredictability has become the norm: socio-political shifts, the

increasing interconnectedness of multinational companies and ever-changing and expanding

body of laws and regulations means that compliance is becoming increasingly complex. As

such, governance, risk, and compliance (GRC) has become relevant now more than ever, and

artificial intelligence-driven technology is equipping organisations to make decisions in the face of uncertainty.

Months after acquiring big data software developer Pythagoria to intensify their data intelligence offering, legal-tech pioneer Afriwise has appointed GRC juggernaut Vishala Panday to champion product innovation and solutions around compliance to empower organisations operating in Africa to navigate complex legal and regulatory landscapes.

As the Head of Compliance Services, Panday’s expertise lies in the intersection of compliance,

technology, and organisational strategy. According to Panday, Afriwise is the next natural step in her career as it presents her with a significant opportunity to consolidate and utilise her diverse and multi-faceted experience to evolve GRC practices across African industries. “I was initially drawn to Afriwise’s client-centricity and commitment to cultivating the cutting edge of legal technology. Afriwise offers a powerful combination of proprietary legal and regulatory databases, AI, and expert analysis from top legal counsel and empowers African-operating businesses to make intuitive, meaningful decisions in real-time. I am excited to apply my depth of experience to develop tailor-made fit-for-purpose client solutions that add real and tangible value to business decision-making and risk mitigation.”

Panday believes that the value derived from structured data, artificial intelligence and

technology in the realm of regulatory compliance is intrinsic to business success. In order to

remain competitive, utilising technology to make quicker and better-informed decisions is a

business imperative. “Ethics and Compliance in business can err on the side of esoteric –

executive buy-in becomes less likely when the value is not explicit, tangible, or visible. My

approach to ethics and compliance is grounded in realism; GRC outcomes must be practical,

cost-effective, realistic to implement, and most of all, business-driven,” says Panday.

Many legal teams across the globe are becoming smaller and leaner, and conversely, the

regulatory landscape is ever-changing and growing. Most organisations do not have the luxury

of additional sets of hands to process reams of legal information in order to ultimately make

business decisions. Leveraging off of structured data and AI makes it possible for lean legal and compliance functions to evolve their roles into strategic business partners by delivering

practical, high-quality, and timely information to critical business stakeholders.

Prior to joining Afriwise, Panday enjoyed a decade-long tenure as Head of Ethics and Compliance at Barloworld Equipment, where she built an ethics and compliance function from scratch using a centre-led approach cutting across all of the African jurisdictions of operation. Within her first 12 months on the job, Panday rolled out an anti-corruption programme that included the management of the whistleblowing line, and investigations into ethical violations. This programme secured her the title of “Changemaker of the Year”, and she credits the ability to sink her teeth into a whole spectrum of ethical issues within a large corporate environment to her intuitive and practical approaches to compliance.

Panday’s non-traditional modus operandi is shaped by a culmination of understanding of

business best practice coupled with her foundational legal experience. “Early on in my career, I

learnt very quickly that assessing GRC through the lens of a traditional legal practitioner was

insufficient. Traditional legal practice means that the in-house counsel or legal advisor operates at arms-length of the core business environment, operating simply as a support functionary who generally advises reactively, rather than strategize with stakeholders proactively. In order to be effective in my role as a GRC functionary, I needed to become part of the business. To enhance her business and strategic acumen, Vishala went on to pursue a BCOM in Finance early on in her career, shortly after acquiring her LLB degree, and more recently, during 2022 completed an MPhil in International Business through the Gordon Institute of Business. It is this business acumen that provides me with a more practical approach to the application of ethics and compliance within corporate settings.

Steven De Backer, CEO and Founder of Afriwise says that Panday’s vision will pave the way

for even greater business success. “Vishala Panday is a highly regarded GRC professional and

it is a great privilege to have her on board to develop new and innovative products and help

evolve our compliance offering. Vishala is an individual of astute moral integrity with a wealth of knowledge; she will be a guiding force to not only transform how we do business but set a new standard for the industry at large. In many ways, she feels like Afriwise’s missing puzzle piece.”

CONTACT INFORMATION

Issued on behalf of Afriwise by:

Lauren Crooks

lauren@lockandkeyconsulting.co.za

+27 82 078 7199

ABOUT AFRIWISE

Leading provider of integrated legal and regulatory intelligence solutions in Africa

Afriwise is an award-winning legal intelligence platform, transforming and democratising access to legal and regulatory information across Africa and beyond. At Afriwise, we help organisations, whatever their size, advance their business in Africa and gain a competitive advantage by providing them with business, legal, and regulatory intelligence based on technology and human expertise.

Afriwise is the result of years of experience and trust building, through close

collaboration with firms across Africa, to give you easy and instant access to the expertise and

know-how you need about local markets on the continent. Our collaboration with over 150 law

firms on the continent is further testimony of our team’s deep links within Africa. By leveraging our unparalleled database, cutting-edge NLP technology, in-house expertise, and extensive network we help solve our clients’ most pressing legal and regulatory challenges.

Video:

Website: www.afriwise.com

Business

BMW and Jaguar used banned China parts – US probe

BMW, Jaguar Land Rover (JLR) and Volkswagen (VW) used parts made by a supplier on a list of firms banned over alleged links to Chinese forced labour, a US congressional report has said.

At least 8,000 BMW Mini Cooper cars were imported into the US with components from banned Chinese firm Sichuan Jingweida Technology Group (JWD), according to the report by Senate Finance Committee chairman Ron Wyden’s staff.

“Automakers’ self-policing is clearly not doing the job,” the Democrat Senator said.

Jaguar Land Rover told the BBC it “takes human rights and forced labour issues seriously and has an active ongoing programme of human rights protection and anti-slavery measures”.

BMW and VW did not immediately respond to requests for comment.

Mr Wyden also urged the US Customs and Border Protection agency to “supercharge enforcement and crack down on companies that fuel the shameful use of forced labour in China”.

The report added Jaguar Land Rover had imported spare parts which included components from JWD after the company was put on the banned list.

JLR said it has now identified and is destroying any stock it holds around the world that include this component.

In February, VW said thousands of its vehicles, including Porsches and Bentleys, had been held by authorities because they had a component in them that breached America’s anti-forced labour laws.

VW had voluntarily informed customs officials about the issue, the report said.

Congress passed the Uyghur Forced Labor Prevention Act (UFLPA) into law in 2021.

The legislation is intended to prevent the import of goods from China’s north-western Xinjiang region that are believed to have been made by people from the Uyghur minority group in forced labour conditions.

JWD was added to the UFLPA Entity List in December 2023, which means its products are presumed to be made with forced labour.

China has been accused of detaining more than one million Uyghurs in Xinjiang against their will over the past few years.

Authorities have denied all allegations of human rights abuses in Xinjiang.

“The so-called Uyghur Forced Labor Prevention Act by the US is not about forced labor but about creating unemployment. It does not protect human rights but, under the guise of human rights, harms the survival and employment rights of the people in Xinjiang,” Chinese Foreign Ministry spokesperson Wang Wenbin said.

“China strongly condemns and firmly opposes this. We will take measures to resolutely safeguard the legitimate rights and interests of Chinese enterprises.”

© BBC News

Business

Sony sees higher profit from image sensors, to conduct stock split

Sony Group (6758.T), said on Tuesday it sees operating profit growing 5% to 1.28 trillion yen ($8.2 billion) this business year with a boost coming from its image sensors.

Sony is a major supplier of image sensors for smartphones and that business is expected to book a 40% rise in operating profit on higher sales and lower costs.

The Japanese conglomerate said it would conduct a five-for-one stock split and buy back up to 2.46% of its shares worth 250 billion yen.

It sold 20.8 million PlayStation 5 units last year, narrowly missing its revised target of 21 million units issued in February following weaker-than-expected sales over the year-end shopping season.

Sony sees profits at its gaming business rising 7% in the current year due to smaller hardware losses as it sells fewer consoles, and higher sales from its PlayStation Plus subscription service.

Known as the inventor of the Walkman and the MiniDisc, Sony has transformed from an electronics manufacturer into an entertainment and technology juggernaut spanning movies, music and games and chips.

The Japanese tech conglomerate plans a partial spin-off of its financial unit with a listing in October 2025 in order to focus on its entertainment and chips units.

The gaming sector has been hit by a slowdown with Xbox maker Microsoft (MSFT.O), last week moving to shutter studios including Tokyo-based Tango Gameworks in the latest cost-cutting measures.

Sony said in February it would lay off 900 workers at its gaming business and shutter a London studio.

Sony Pictures last week sent a letter expressing interest in acquiring Paramount (PARA.O), with private equity firm Apollo (APO.N), Reuters reported.

A deal would create a formidable Hollywood studio with a share of around 20% of the North American box office.

In the year ended March, Sony recorded a 7% fall in operating profit, due to lower profits at its life insurance business. The result was in line with estimates.

© Reuters

Business

Eskom’s energy availability factor has breached the 70% as R53 million spent on diesel last week to power Open Cycle Gas Turbines

Electricity Minister Kgosientsho Ramokgopa stated on Monday that Eskom’s Energy Availability Factor (EAF) has breached the 70%, while just over R53.4 million was spent on burning diesel to power the Open Cycle Gas Turbines (OCGT) last week.

Eskom has consistently defended it’s use of OCTG’s, saying it was only being used during morning and evening peaks to meet high electricity demand when it is necessary.

The power utility says South Africa is currently in a load shedding free environment, not because they are burning diesel to keep the lights on, but because of their extensive maintenance programme and success of their Generation Operational Recovery Plan, which was initiated in March last year.

According to Ramokgopa, who spoke during a media briefing on Monday, the EAF has breached the 70% mark and is currently tracking at 70.78%. This is the first time the EAF has breached 70% since August 2021.

For the month-to-date, the EAF is at 64,34% and year-to-date (YTD) the EAF has reached 59,92%.

Load shedding has been suspended for 47 consecutive days during which time the OCGT usage has been lower than the same time as last year. Ramokgopa said between May 5 to 11, OCGTs were in use for just four days, with just over R53 million spent on diesel on those four days.

On Monday, R23.5 million was spent on diesel to power the OCTGs, R11.9 million was spent on Tuesday and Wednesday, and R6.4 million was spent on Thursday.

Eskom said that South Africa has been without load shedding due to the utility having sufficient generation capacity from a more reliable generation fleet and has denied reports in the Mail and Guardian that it was overusing its diesel-burning OCGTs.

In April this year, Eskom spent R1.1 billion on OCGTs, producing 167.8 Gigawatt hours (GWh).

This was about 60% less than April 2023, when a staggering R3.1 billion was spent to produce 470.22GWh, the utility said.

Ramokgopa said that the OCGT load factor for April 2024 decreased significantly to 6.8% compared to last year’s figure of 19.13%.

Eskom said that its diesel budget from May to June was R5.8 billion, and only R1.16bn had been spent as of May 9, 2024, or 19.7% of the total budget.

Generation performance

The minister said that consistently good performance has come from the Kusile, Lethabo, Majuba, Matla and Medupi power stations, and these stations have helped contribute to the EAF trend.

Eskom noted that Medupi and Lethabo, specifically, have achieved a YTD EAF greater than 70% (peaking at 87.6%,) by the end of March 2024.

In terms of stations showing an improved trajectory, the minister said that the EAF has been assisted by improving performance from the Arnot, Camden, Hendrina and Grootvlei power plants.

He said suspension of load shedding is driven by an improvement in coal fleet performance, supported by solar during the day.

On Friday, Eskom said in a statement that unplanned outages have reduced by 4,400MW since April 26, 2024, due to extensive maintenance.

“Eskom’s outlook for the winter period of 2024 states it will continue to strategically utilise its peaking stations, including OCGTs – these will be dispatched during morning and evening peaks to meet high electricity demand, when necessary,” Eskom said.

‘End of load shedding is in sight’

On Monday, President Cyril Ramaphosa praised the Energy Action Plan and said that the end to load shedding is in sight.

“It is too early to say that load shedding has been brought to an end. However, the sustained improvement in the performance of Eskom’s power stations, as well as the new generation capacity we have added to our energy system gives us hope that the end of load shedding is in sight,” Ramaphosa said in his weekly newsletter.

“A renewed focus by Eskom on maintenance and the return to service of several units is now showing results. Losses due to unplanned outages have reduced by nine percent between April 2023 and March 2024, adding the equivalent of 4,400MW of capacity to our national grid,” he added.

“Better maintained and more reliable power stations have increased the country’s EAF. The EAF has been above 60% since April, compared to 53% over the same period last year.”

Ramaphosa also praised Eskom’s leadership team and highlighted the work done by the power station general managers and their teams.

“The leadership, management and staff of Eskom, particularly the power station general managers and their teams, are to be commended for their efforts. The work of the National Energy Crisis Committee, which coordinates the response across government, has also been vital. The strong partnership with business and the support of other social partners has enabled the deployment of valuable resources and expertise,” he concluded.

© IOL

You must be logged in to post a comment Login